How have yields changed for landlords?

As a landlord, your property’s yield is an important figure. It indicates the level of return your property investment is generating and can be used to track the performance of your property over time, so you can compare it with other buy-to-let properties and market averages, as well as other types of financial investment.

Generally speaking, because house prices vary more than rents in different parts of the UK, properties in more expensive areas (e.g. London and the South of England) tend to have lower rental yields but grow better in value, while those in more affordable areas (e.g. the Midlands and North of England) have higher yields but don’t benefit from such good capital growth. It’s a trade off, so while those who are more focused on long-term capital gains might be less interested in the yield figure, landlords who rely on getting monthly income from their investment find yields more useful.

How have yields changed over recent years?

During the early part of the pandemic and up until the middle of last year, average house prices were rising well, but so were rents, so gross yields were pretty stable. Rising rental income meant many landlords were able to maintain their profit levels, despite the increasing cost of living.

According to Paragon Banking Group, in Q4 of 2020, the average gross yield in England was 5.8%, ranging from 5.1% in Central London to 6.4% in Yorkshire & Humber and the East Midlands. Almost two years later, in Q3 of 2022, despite some fluctuation in the interim, there was very little change: the average for England was at 5.8%, ranging from 5% in Outer London to 6.3% in the North East and Yorkshire & Humber.

Meanwhile, Rightmove’s rental price tracker for the second quarter of this year across the whole of the UK, shows average yields varied from 5.3% in London to 8.3% in the North East of England, with all regions – as well as Scotland and Wales – up slightly on 12 months previously.

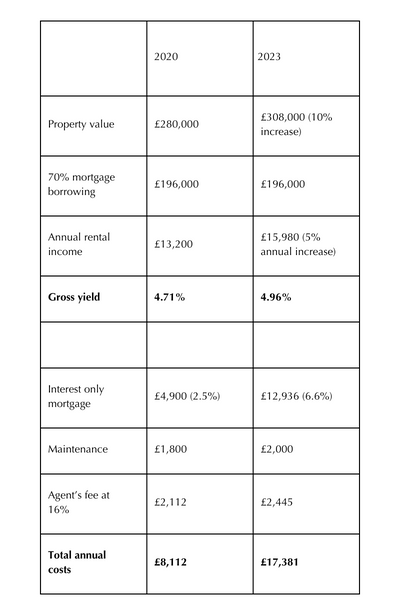

However, while gross yields are doing well, landlords with mortgages are now likely to be seeing their net yield drop. Since the Bank of England base rate started rocketing last August, mortgage lenders have been following suit, and this year we have seen mortgage interest rates climbing to their highest for 15 years. In July, the rate for a typical 2-year fixed deal rose to 6.66%, according to Moneyfacts - that’s nearly three times what it was at the end of 2020, meaning monthly payments could have nearly tripled for some landlords, which could wipe out their profits entirely. If they’re unable to increase their tenant’s rent and reduce other costs, they may even have to subsidise their investment.

For example:

Although the annual costs have increased, the property has still delivered well from a capital growth perspective and as rates are forecast to drop in the future, mortgage costs are likely to reduce in the future.

What this demonstrates is the importance of planning ahead and stress-testing your figures when you make a buy-to-let investment or when there are major changes such as mortgage rates. You should always know where your break-even point is and constantly track your income and expenditure so that you can anticipate a financial squeeze and take steps to mitigate it.

Ways to increase yield?

For instance, you could increase your tenant’s rent (bearing in mind you can typically only do that once a year) – and if you have a change of tenancy, you may be able to make a more significant increase. In terms of the mortgage, you could use other capital to pay down your buy-to-let borrowing, and if your property has increased in value well since you bought it, you may be able to refinance at a lower LTV and get a better interest rate.

If you purchase a property at below market value, or find a way to add value, these strategies can help boost your yield, as can renting individual rooms instead of a whole property and doing things like paying off a lump sum of your mortgage to reduce your Loan to Value.

To discuss how you might be able to improve your property’s rental income and yield and find out about local averages, just get in touch with your local branch and speak to one of our lettings experts. And if you would like to discuss mortgage options, our partners at Mortgage Scout will be happy to help.

Looking for advice?

If you're looking to let or sell your property, we can help. Get in touch with your local branch or book in for a property valuation.

Contact Us

Got a question, general enquiry or something else?

You may also like

Since we started in 1987 we have grown to one of the UK’s largest property groups, we can save you time and money by offering a range of services and expertise under one roof.

Away for the holidays? Essential tips when leaving your rental property empty

Away for the holidays? Essential tips when leaving your rental property empty

Think Green when you Clean

Think Green when you Clean

Where should I be looking to invest next year?

Where should I be looking to invest next year?

Our mortgage predictions for 2025

Our mortgage predictions for 2025

Predictions for the lettings market in 2025

Predictions for the lettings market in 2025

Predictions for the sales market in 2025

Predictions for the sales market in 2025

What can I do as a landlord to ‘future-proof’ my business?

What can I do as a landlord to ‘future-proof’ my business?

Want to buy in 2025? Setting realistic goals as a first-time buyer

Want to buy in 2025? Setting realistic goals as a first-time buyer

How to spruce up your rental for 2025 on a budget

How to spruce up your rental for 2025 on a budget